CPAs are in high demand in a variety of businesses. Almost every organization needs public accountants and auditors.

Many CPAs work as tax experts or business consultants, and their skills and training allow them to command significant wages. As a result, most organizations strive to keep their accounting skills by granting frequent wage increases and bonuses.

A newly licensed CPA with less than one year of work experience may expect to earn an annual accountant salary of around $66,000, according to a poll done by the Association of International Certified Professional Accountants (AICPA).

In the United States, the average compensation for a CPA is $119,000. CPAs with vast expertise working in the accounting and financial industries might earn significantly more. An employee with 20 years of experience may get an annual accountant salary of $152,000 on average.

It is important to note that these figures do not include bonuses, which might amount to 10% of yearly earnings. CPAs can also expect annual compensation increases ranging from 4% to 5%.

Of course, the accountant salary of a CPA is determined by a variety of circumstances. Your income level is determined by the number of years of experience you have, the industries in which you have worked, and the kind of the work that you have handled.

Popular Jobs and Industries For CPAs

It is very likely that your job will demand you to make extensive use of the skills and expertise you obtained while earning your CPA. A CPA is often involved in one or more of the following areas:

- Organization and upkeep of financial records and statements

- Tax-related activities include tax computation, tax return preparation, and tax payment.

- Ensuring that accounting regulations are followed

- Having said that, CPAs might choose to work in a variety of different businesses.

More information on some of the most popular options may be found below:

Corporate Accounting

The major responsibility of a corporate accountant is to analyze data, handle financial reporting, and assure regulatory compliance. Budgeting and forecasting are also part of the job. Corporate accountants are typically in charge of preparing reports utilized by senior management to make decisions.

Salaries for corporate accountants can vary greatly, according to Robert Half Salary Guide, a human resource consulting business. A Financial Analyst with up to one year of experience may expect to earn between $42,500 and $80,750 per year. In addition, financial analysts with one to three years of expertise might earn between $55,000 and $105,000 per year.

Tax accountants, cost accountants, and general accountants with comparable experience can earn wages in this range as well.

Public Accounting

Accounting and associated services are provided by a public accounting firm to other entities. CPAs in public accounting firms are typically involved in auditing customers’ financial statements, preparing tax returns, and advising clients in the preparation of their financial statements.

A public accounting business might be as small as a handful of employees or as large as a large corporation. Deloitte, EY, KPMG, and PwC are the “Big Four” accounting firms. Their full names are:

PwC – PricewaterhouseCoopers Deloitte – Deloitte Touche Tohmatsu

Ernst & Young (EY) KPMG (Klynveld) Peat Marwick Goerdeler Peat Marwick Goerdeler Peat Marwick Goerde

These accounting firms have clientele all across the world. Each of them employs hundreds of thousands of people. Deloitte, for example, employs nearly 250,000 people.

What do the Big Four get paid? Here’s a quick rundown:

Deloitte provides beginning salaries ranging from $45,000 to $60,000. PwC, EY, and KPMG also pay around the same amount to CPAs who have recently passed the CPA exam.

Financial Services

CPAs have traditionally worked in accounting, auditing, and taxation. However, there are more career chances in the banking and financial services sector.

Credit analysis, commercial financing, and risk management are all areas where a CPA’s experience is highly valued. Many financial services organizations need competent accountants to perform reporting and compliance functions.

How much can a CPA expect to make working for a financial services firm? Here’s what we discovered:

According to Robert Half Salary Guide data, a credit analyst with one to three years of experience can expect to earn between $44,000 and $83,500 per year. Accountant Salary ranges in the top range are typically offered to applicants with specific experience as well as extra qualifications related to the position.

Credit analysts with five or more years of experience might make between $67,750 and $129,000 per year. Again, you’d need a high level of experience to earn an offer of $100,000 or more.

Accountant Salary

Before we go into accounting salary, I’d like to remind you that accountants and CPAs can work in a variety of situations, including public, private, industrial, governmental, and educational settings. As a result, the remuneration of a private tax accountant at a small firm may range significantly from that of a senior accountant at a major organization.

Furthermore, more experienced accountants and CPAs typically earn more than the average accountant starting pay. So, in this essay, I’ve done my best to go through average accountant salaries. However, depending on the environment and whether you are eligible for incentives and profit-sharing, overall CPA wages and pay can be significantly greater than what I will discuss in this article.

I’ve compiled research from the AICPA (American Institute of Certified Public Accounting), the US Bureau of Labor Statistics, several job search websites, and the 2022 Robert Half CPA Salary Guide, a standard resource for salaries in the finance and accounting field, to help you better understand your potential accounting job CPA salary.

CPA Salaries Vary State To State

The amount that a CPA is paid is determined by a variety of criteria, including the number of years of experience and the type of work that you have done.

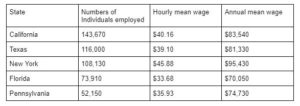

The state in which you work is another element that determines your CPA salary. California has the most career prospects for accountants and auditors. According to data published by the Bureau of Labor Statistics, a division of the United States Department of Labor, there were 143,670 accountants and auditors in California in May 2017.

Check out our table below to learn more about the states with the greatest levels of accountant employment:

States with the Highest Number of Accountants & Auditors (May 2017)

Which states pay the highest for accountants and auditors? Continue reading to find out!

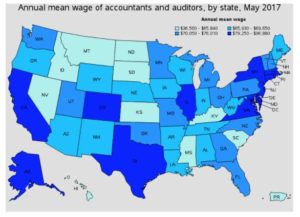

The District of Columbia has the highest average yearly wage in the country, at $96,880. Following that are New York ($95,430), New Jersey ($91,400), Virginia ($84,740), and California ($83,540).

Here’s a color-coded map that shows the wage levels in several states:

Annual Salaries of Accountants and Auditors by State (May 2017)

CPA salary levels vary per state, as one would anticipate. According to data published by Robert Half, salaries for the same type of employment vary greatly throughout cities. Starting salaries in California, for example, range from 13% below the national average to 41% above it, depending on the city in which you work.

This type of variation can be seen all around the country. Washington, D.C. salaries are 33% more than the national average. They outperform the national average by 40.5 percent in New York City.

Why are pay for the same type of employment so different? Here are a few of the reasons why:

One explanation is that the expense of living in some cities is exorbitant. A higher annual wage rewards you for your higher outlay. However, there could be other explanations. When there is a scarcity of skill in a certain field, employers may be willing to pay more. If you have a special expertise that the company is seeking for, you may be in a strong negotiation position.

Compare CPA Vs. Other Accountant Salaries

CPAs can compare their pay to those of other accounting and auditing professions by using an AICPA-created tool. The pay comparison tool needs you to enter the country and state where you work, as well as an industry. Following that, you must enter your CPA salary and bonus figures.

Based on the information you submit, the tool will generate a report that includes information about how much other CPAs in the state and country earn. You will also be able to discover information on the average yearly pay and bonus % for your industry.

Remember that the findings provided by the interactive CPA salary tool are illustrative and may not be 100% accurate in real life. They are based on an AICPA pay survey performed in 2017.

Tips To Negotiate A Higher CPA Wages

When you are being interviewed for a job, it is often easy to persuade your prospective employer to increase the initial pay offer. Of course, if you are applying for your first job, huge organizations like the Big Four accounting firms may be unwilling to negotiate a pay deal. Smaller businesses, on the other hand, can be more adaptable. Furthermore, if you are changing employment, you have a better chance of convincing the firm to raise the recommended yearly wage.

So, how can you go about getting a better bargain for yourself? Continue reading to find out!

The first thing you should do is conduct extensive research on the employer. This can help you make a strong first impression and indicate that you are a serious candidate throughout the interview.

You should also be ready to answer questions that will put your professional expertise to the test. Most employers will want to know if you stay up to date on new accounting regulations. You should prepare to answer this question, as well as others related to your area of expertise.

Here are some additional negotiating strategies you might employ to increase your new CPA salary:

- Never show your hand. If you are prompted on the application form to mention an estimated CPA salary, leave it blank. Allow the corporation to make the first offer.

- Don’t reveal your present CPA salary. Your new employer should offer you a CPA salary that matches the value you will provide to their organization. This has nothing to do with your existing income.

- Prepare a well-researched counter-offer when the employer presents you with the recommended wage. You must be able to substantiate your request.

Above all, keep in mind that you must bargain. Most businesses are willing to increase the initial number they supply. However, it is up to you to inquire.

Demand for CPAs is Growing

CPA salaries are projected to rise in the next few years. According to the AICPA’s 2017 Compensation Survey, CPAs projected their pay to climb by 5% over the next year. Salaries had increased by 4% the previous year.

The strong demand for accountants and auditors is one cause for rising compensation. The US Department of Labor anticipates a 10% growth in the need for accounting and finance talent between 2016 and 2026.

Professional accountants who have recently taken the CPA exam have a variety of work opportunities. It is realistic to expect consistent improvement in your income over the course of your career. Moving to a new firm can also assist you speed up the process of earning a pay raise.

However, before you move positions, you should consider the advice provided by Mark Koziel, the AICPA’s senior vice president-Firm Services. “Accounting careers are a marathon, not a sprint.

“Sometimes, I believe that people quit outstanding enterprises for the sake of short-term financial gain rather than the long-term potential. So, when comparing your salary circumstances, make sure to look at the big picture.”

What is the Role of CPA Designation in Your Career?

In summary, these are some of the reasons you should think about earning your CPA license:

- In general, becoming a CPA will result in a pay increase of 10-15%. After that, most companies will give you a raise every year. Consider the totality of the situation.

- As you advance in your profession, especially if you work for a CPA firm, you must obtain your CPA license. This is especially true if you want to be a partner.

- Even in corporate accounting, if you want to be a controller or CFO, prospective employers will want you to be a CPA. If you postpone and don’t finish this until 15 years after you start your profession, it’s just harder to go back to the textbooks and tackle tests at that age.

Accountant Job Salary for CPA + Other Qualifications

We’ve discussed CPA salaries, but what if you hold the CPA in addition to another high-level certificate, such as the CIA, CMA, or EA? What if you hold a master’s degree, such as an MAcc or MBA, and want to acquire your CPA? So, how much could your accounting salary be? Let’s take a look at some instances gleaned from Payscale.com data:

- The average CPA salary (regardless of college degree) is $66,287.

- The average salary for a Master’s Degree in Accounting is $70,606 per year.

- Salary for an MBA in Accounting: $73,756 on average

- The average MBA salary is $88,000.

Of course, these averages are just that—averages that take into account everything from entry-level to high-level salaries. However, as you can see, an accounting degree pay can be higher if you have an advanced degree.

What’s the Job Future Like?

Making a good accountant income is excellent, but keeping that position with a good accountant salary is even better. What is the prognosis for accounting professionals in today’s unpredictable business environment?

Accounting and other finance experts, on the other hand, are still in high demand in the United States. Indeed, as the corporate world evolves, specialists such as CPAs will be required to assist businesses in adapting to new situations.

According to the 2022 Robert Half CPA Salary Guide, the following positions will remain in high demand for the foreseeable future:

- Accounting manager

- Business analysis

- Controller

- Financial analysis

- Internal auditor

- Payroll manager

- Senior accountant

- Staff accountant

Talent Shortages

Due to talent shortages in certain industries, CPAs and other licensed accounting experts have become extremely important to their employers. The demand is particularly acute in public accounting. More qualified individuals are also needed in the financial services business, particularly those with experience in banking, financial markets, risk, compliance, and other financial operations.

You may be able to negotiate a better wage if you have these desired qualifications and work experiences.

FAQs

How much does a certified public accountant make a year?

A newly licensed CPA with less than one year of work experience may expect to earn an annual accountant salary of around $66,000, according to a poll done by the Association of International Certified Professional Accountants (AICPA). In the United States, the average CPA salary is $119,000. An average CPA with vast expertise working in the accounting and financial industries might earn significantly more.

An employee with 20 years of experience may get an annual accountant salary of $152,000 on average. It is important to note that these figures do not include bonuses, which might amount to 10% of yearly earnings. CPAs can also expect annual compensation increases ranging from 4% to 5%.

How much does a CPA make in 2023?

In the United States, the average compensation for a CPA is $119,000. According to the AICPA’s 2017 Compensation Survey, CPAs projected their pay to climb by 5% over the next year. Salaries had increased by 4% the previous year. The strong demand for accountants and auditors is one cause for rising compensation. The US Department of Labor anticipates a 10% growth in the need for accounting and finance talent between 2016 and 2026.

Can accountants make a lot of money?

In the United States, the average compensation for a CPA is $119,000. CPAs with vast expertise working in the accounting and financial industries might earn significantly more. An employee with 20 years of experience may get an annual accountant salary of $152,000 on average. It is important to note that these figures do not include bonuses, which might amount to 10% of yearly earnings. CPAs can also expect annual compensation increases ranging from 4% to 5%.

Is the CPA exam hard?

The CPA exam is famously difficult, with cumulative passing percentages just slightly more than 50%. Each of the four CPA exam portions has a different pass rate. The FAR portion is statistically the most challenging, with a CPA Exam pass rate of just under 50% (46.9 percent) in 2019.

Is CPA better than CA?

The primary distinction between the CPA and CA is that the CPA certification is only valid in the United States, whereas the CA designation is valid globally. While each credential has advantages and disadvantages, if you intend to work primarily in the United States, the CPA designation is favored.

Are CPAs in demand?

Yes. The US Department of Labor anticipates a 10% growth in the need for accounting and finance talent between 2016 and 2026.

Do auditors travel a lot?

Yes. External auditors travel considerably due to the clients they usually serve in multiple geographical places. Internal auditors (in-house) travel regularly as well, but typically solely between the company’s various offices or branches.

How much do CPAs make at the Big 4?

For a position as an accounting associate at PricewaterhouseCoopers, the starting compensation ranges from $48,000 to $68,000. The starting compensation for a Deloitte employee is from $45,000 to $60,000. The typical tax accountant pay at KPMG ranges from $46,000 to $62,000 (although it’s a good idea to stay for 5 years because the average compensation jumps to $106,000). For an entry-level role, the average starting CPA compensation at Ernst & Young is between $40,000 and $63,000.